The Best Garage Sale I'll Ever Have

Just slightly over a year ago, I had probably half of my worldly possessions go up in flames. I posted an account of it on my web site, but I always meant to follow that up with the (mostly) happy ending.

Just slightly over a year ago, I had probably half of my worldly possessions go up in flames. I posted an account of it on my web site, but I always meant to follow that up with the (mostly) happy ending.

Barely two months before the fire caught us by surprise, my fiancée and I were engaged in engagement ring shopping. Throwing that whole “two month’s salary” thing right out the window, I had decided (without the DeBeer’s corporations input, thankyouverymuch) that a $1500 to $2000 ring would adequately demonstrate my love for her. We looked at Costco. We looked at over-priced jewelry stores downtown that typically cater to tourists with more money than I. Some rings were cheap, some we wanted to buy, but unfortunately, none of the ones we wanted to buy were cheap.

One day, Oksana was going through her old jewelry and pulled out a gaudy ring that could almost fit on my thumb. It had a gigantic, eight-pronged CLAW holding a diamond that was large enough and clear enough that we decided it just had to be fake. Long story short: It had been a gift her dad had given her mom way back in communist Russia and a $20 appraisal revealed that we really shouldn’t carelessly misplace it.

The choice was obvious: The ring had to go and the diamond had to stay. We laser-inscribed a single facet of the stone with her family name; created a custom, Oksana-original band; and promptly called USAA, my auto insurance company. They informed me that: 1) Yes, they’d insure the ring, 2) but it would be a “rider policy” hence we would first need to pay for renter’s insurance, and 3) we could save a lot of money by switching Oksana’s car insurance — but that’s beside the point.

For about $300 a year, we received a $25,000 renter’s insurance policy that had too many conditional to follow. War? No, not covered. Aerial and space debris? Yes, covered. Destruction brought about by aerial objects, such as missiles, used in war? No. The list of what was and wasn’t covered in our policy was too long to read without more caffeine, so I just ignored it and moved on to the ring policy – which is all we were really after. (Heck, the ring policy was easy to decipher by comparison. Basically you could do anything but irradiate it or intentionally throw it away!)

Then one terrible day in June, when the fire took out storage unit J238, I immediately thought about that mile-long list of qualifiers in our coverage. Fire? Maybe it won’t cover the loss if there were no sprinklers or something. I could imagine the telephone conversation: “Your property was in a mini-storage unit? Oh, gee, we’re sorry – your renter’s policy only covers items in the APARTMENT you rent. Don’t forget your next payment is due at the end of the month!”

After sorting through the (non) remains of my unit (which had been bulldozed to make a path into the building’s rubble, by the way) I went home to read that policy. In the middle of all those qualifiers, damage by fire was included. Low and behold, it was practically the only one that didn’t have any conditions attached to it! (Water damage? Covered. Provision #642: Unless it was due to rain, or a flood, or a broke water pipe, or…) I’m no insurance agent, but darned if it didn’t also look like our property would be covered anywhere in the world. Which was lucky because, until the day before, that’s where the mini-storage was located.

Too good to be true? Probably. Time to call USAA.

I dialed them up and gave my claim information to a telephone peon. Of course, they couldn’t answer my questions because they couldn’t bring up my policy – that wasn’t their job, anyway. I would just have to wait until my claims adjuster contacted me.

It wasn’t too long before she did, though. Her name was Jana and she told me she was probably going to have to come up to Juneau to survey the site before the company could proceed. Apparently they had insured at least four people that had belongings in that building. I assured her that there wasn’t much to salvage for anyone, but for some unfathomable, internal reasons she was going to have to do a site inspection. Too bad they were going to bulldoze the place before she could get here, because she had to follow up on claims in Anchorage first. In the meantime, she’d mail me a packet that would take me step-by-step through the painstaking process of detailing every lost item.

By the time that packet had arrived in the mail, I’d already drafted a considerable list. The hardest thing to categorize was the collection of 4000 or so comic books I had in there. I hadn’t looked at them since high school, but they were all protectively bagged and boarded as an investment towards the future. How would USAA let me list their value? Could I get away with a blanket statement of, say $2 or $3 per comic? Or would have I have to list every, single issue? Crikey.

Other items were easier to deal with. For instance, I had hundreds of audio CD jewel boxes sitting in mini-storage because I had the discs in a jukebox-like changer at home. My collection of 400+ paperback books just happened to have been cataloged quite well when I boxed them up in preparation of the move from my trailer to an apartment. (I found the complete book list on an old CD-ROM backup of my computer.)

Most of it, though, was a months-long, pain-in-the-ass game of price research and memory spelunking. How many college textbooks did I have in storage? What books, modules, and boxed sets constituted my, potentially collectable, Dungeons and Dragons collection? How much are old clothes worth? How many videotapes did I have in those two, huge footlockers? How much software did I lose, and how much were the two old (yet functional) computers worth?

And yes, Jana made me list every, single comic book issue. The only way I could think to do that was go through all 992 pages of The Official Overstreet Comic Book Price Guide (23rd Edition), page-by-page, column-by-column, entry-by-entry and record every issue of each series I could remember collecting during the five years of my comic book phase (1987-1992). Two or three weeks of intimate evenings spent with a highlighter marker left me with a total of 3243 – 757 short of my estimated 4000 comics. I just crossed my fingers and hoped that USAA would cut me some slack and allow me to estimate the remainder at their lowest possible value (according to the Overstreet Price Guide) of $2.25 each.

If there was anything that delayed the issuance of a check, it was all that work.

Compared to racking my brain for every item in all of the dozens of boxes in that storage unit (and all the emotional agony that goes along with cataloging a loss like this), meeting with my claims adjuster was a pleasure. Jana stopped by the university one day and I took about a half an hour off from work to meet with her. I gave her the photos and videotape I had shot of the rubble that used to be my storage unit and handed over a long list of the personal items I would never see again.

Surprisingly, in such a short frame of time, she took all my items, the estimated values I had attributed to each, and condensed it into a spreadsheet outlining their respective depreciation values. Of course, that early after the accident, I hadn’t yet dredged from my memory every item lost in the fire, and for many of the ones I did know were lost, couldn’t find an accurate estimate for them on the Internet. How do you assign a value to an empty CD jewel case? How much is a 5-year-old computer worth for which you paid more than $3000? (Answer, not a whole helluva lot! Would you believe about $250?) But Jana didn’t let that stand in the way of doing her job. To underscore how pleasurable it was working with USAA: Jana asked me to estimate how many cardboard boxes were in the unit – and then added about $4 to my reimbursement for each one lost! Although I hadn’t yet included the “big ticket items” like my books, collectibles, or comics in the claim, Jana assured me that they could already cut me a check for over $12,000. Two weeks after such a disaster, that was a big weight off my chest.

Eventually, after submitting a claim that included a comic book collection estimated at over $15,000, books over $4000, and audio CDs over $3000, I found myself with a total north of $40,000. After depreciation, I came out just barely above the maximum I was allowed to collect – twenty-five thousand dollars. (They took a nice, round 20% off my comic book collection because they couldn’t believe that every single comic was in mint condition. That was understandable and I wasn’t going to argue because it I couldn’t get more than the $25,000 limit, anyway.)

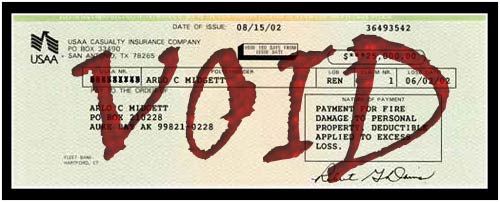

Jana managed to get my check mailed to me just a few days after my wedding and a just a day or two before Oksana and I left on our honeymoon. Twenty. Five. Thousand. Dollars. Two-Five-Zero-Zero-Zero-dot-Zero-Zero – USAA was even kind enough to take the $100 deductible out of the $40,000 estimate! At the time I received that check, I still wasn’t sure that it was worth the loss. Some personal history was lost in that fire. To this day, what bothers me the most is the loss of all my schoolwork collected since the 6th grade. That and a box of souvenirs from 5 trips through 7 Latin American countries. Things I will never be able to replace.

But it could have been much worse. Earlier in the year, I had taken out the box that contained all my home video tapes. And I never did put any of my dozen or so photo albums (and negatives) into storage. In the year since the accident happened, I have only once or twice found myself in need of some material item that exists now as ashes. I guess that’s why all that stuff was in storage in the first place – because I didn’t really need it.

Noah, a good friend of mine, tried to cheer me up with some advice: “It’s the best garage sale you’ll ever have.” At the time I was still too depressed to see the wisdom in it, but now that’s exactly the way I look at the situation. Would you throw out half your material possessions for 25 grand? No? Well, what if it’s just the stuff in your attic?

Anyway, barely two months after the check arrived I spent the last of it. No, there wasn’t a Brewster’s Millions motive or anything! Just a short list of things that I knew in my mind had to be put behind me.

About $16,000 went away, just like that, to student loans and credit card bills. Paying them off made me 100% debt free and, oh, about 80% happy. Most of the rest covered every last dime not already paid pertaining to our wedding and honeymoon. And the last couple thousand dollars bought me something I’ve wanted for a very long time: A tiny Sony Picturebook. In fact, if you’re reading this, it’s likely due to that purchase alone. Having a laptop that I can bring with me anywhere is a huge factor in letting me explore my creativity through writing…

But the best thing the money bought me was the ability to marry Oksana (an accountant, no less) without my financial baggage. After racking up such a debt, I told myself that I would never marry someone until I was free from it, but I knew after a year with Oksana that I couldn’t wait that long and risk letting her get away. When the check cleared, there was that old hesitation: “I could pay off all my debts this month, but maybe I should just pay off half this month and the remainder next month. I mean, the money will still be there, right…?” Ha! That’s what got me in trouble with the credit cards in the first place!

No… paying everything off – every last penny of debt – was the right decision. Now we have no car payments to make, no mortgage, and credit card debts always get paid off by the end of each month (and earn us Alaska Airlines miles, to boot!) Now that Oksana is raking in the dough at her full-time job at the Mendenhall Auto Center, we’re socking away (what seems to me) a ton of money. It’s amazing how much far your paycheck can go when $400 per month isn’t paying interest!

I would like to end this little story on such a happy note, but I don’t think it would do justice to this small chapter in my life. Not once, not even when receiving the largest check I’ve ever seen, did I consider this to be a “good thing.” No, I wouldn’t wish an accident like this on anyone…

Did I say accident? Oops. Did I forget to mention that I went through this because someone intentionally burned my, and hundreds of others’, property to the ground?

In the weeks and months that followed the fire, Juneau police were called in to investigate. If Knightwatch Security had checked the building earlier that morning at 4am, why had all the fire doors been opened allowing the fire to spread so quickly? The Juneau Police Department offered a reward to anyone that had information about the fire and it wasn’t long before someone called into to tell them about a couple young adults that might have broken into some storage units that same night.

This rumor made its rounds around town and it wasn’t long before the Police called and asked me to come down to the station. The first thing officer Sell told me was that I shouldn’t get my hopes up. “Thieves are like raccoons; they usually only take whatever is bright and shiny.” She wasn’t kidding. These geniuses that broke into the storage complex made off with a set of screwdrivers, someone’s button collection, a butane lighter refill kit, and other assorted knick-knacks. It was depressing not to find any of my own property among that recovered, but I hoped that someone else, at least, would be able to identify the stuff as their own (and consequently be able to press charges.)

Apparently someone did, because more of the story was later reported in the newspaper. Yes, they did find and arrest two people – it wasn’t hard to find these two criminal masterminds, either. You know where they were? In the Juneau Correctional Facility awaiting their trial for stealing cash and checks from the Gastineau Human Society earlier that weekend.

In talking with the police, I found out that they were to be charged with arson in the first degree – the best that could be hoped for (from my perspective, at least.) I remember remarking, “We’ll sure, since they were responsible for the destruction of millions of dollars worth of property!” Officer Sell then informed me that monetary value had nothing to do with it. Only because the firefighters’ lives were put in danger (when the roof collapsed, and when propane tanks started going up, and when approximately 3000 rounds of ammunition cooked off) was the charge automatically raised to Arson in the First Degree.

I stopped following the whole situation in the Juneau Empire when I heard that one of the hooligans plead completely out of the charges and the other’s sentence was reduced when he agreed to plead guilty to the earlier “crime spree.” Things like that make me lose faith in the human race as a whole, and there’s no sense dwelling on them.

You know really gets me, though? What drives me nuts about the whole situation? If those two bozos had simply cut the locks, stole their $100 dollars worth of crap merchandise and left well enough alone, the police would probably have told the owners that there wasn’t anything they could do. But, no. They opened the fire doors and burned the place down to “cover fingerprints they may have left at the scene.” After the fire, of course the police would be under a lot of public pressure to find them – they caused millions of dollars worth of damage, destroyed people’s lives! Offer a big enough reward and their own mothers would probably turn them in!

You know we should do? I think we should wait for these punks to grow up, start a family, take a lot of photos and build up their households… then show up one day and present a court order to burn it all to the ground!

Sounds harsh? Well, I was one of the lucky ones. A good friend of mine had packed everything he owned into that storage building in anticipation of moving to Seattle. After the fire, he was left with a single change of clothes (gym clothes) and his computer. He lost everything else. Can you imagine? Your clothes, your furniture, your software. Years’ worth of collected “demo reel” material mere weeks before you begin looking for your dream job? And you know what? He didn’t have insurance.

If there’s a moral to this story, I guess that’s it. If you don’t have homeowner’s or renter’s insurance, you should call an insurance agent right now and get it! It’ll cost you maybe a half-hour on the phone and, if you’re like us, about $25 a month. Paying for insurance never seems like it’s worth it… until you need it.

My name is Marjorie Woeber. Previously Marjorie Baguya.I am most likely related to one, Cresencio Baguya or Bagoyo,(name depending on weather or not he changed the spelling of his name like the rest of the family. Or, if it was never Baguya in the first place.)

I am replying to all that I have read on this one particular sight. I have to say that it is so unfortunate for yourself and all of those that have greatly suffered in this very sad tragedy. I can’t begin to understand how any of you must feel. I pray that emotionally and finacially, many of you by now, are doing better. I hope that this does not sound insulting in any way at all. For, that is not my intent. I am very much ashamed that I am even possibly related as a 1/2 sister to one of those so called hoodlums. I have never been close to him, and nor will I ever. I disown anyone that can commit such a stupid, idiotic, heart-wrenching crime. I was never really in the know of how devestating the burning down of the mini storage was. Thank you for informing myself and the public of this much needed insight from your point of view as the victim(s).

Wow